I seem to use the word "disingenuous" a lot in this blog, but then there's a lot of it around. Here's another example.

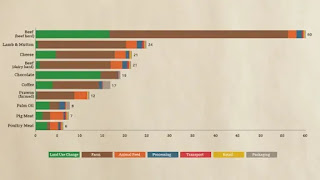

The US Securities and Exchange Commission is proposing that publicly-listed companies account for their total "life-cycle" greenhouse gas emissions. This includes Scope 1 emissions (greenhouse gases produced directly by the company's operations), Scope 2 emissions (greenhouse gases produced by company purchases, such as electricity to power the business), but also, critically, Scope 3 emissions (indirect emissions produced by the business, such as those emitted by end users of a company's product).

This would be a ground-breaking development, and potentially a huge step in managing carbon emissions. There is still a long way to go before such a requirement can be agreed and implemented, though, and it would admittedly be a pretty onerous requirement. There is, predictably, a lot of pushback to the idea from industry groups and Republican lawmakers. The Canadian Securities Administrators are mulling a similar rule, if the US does eventually pass it.

The requirement to disclose Scope 3 emissions in particular is being fought tooth and nail by the oil and gas lobby in the US, for obvious reasons. About 80% of the emissions of oil and gas companies are created by their end customers - after all, oil and gas companies essentially exist in order to create greenhouse gas emissions, it's what they do. For example, Cenovus Energy, which is one of only a few companies already voluntarily disclosing their Scope 1, 2 and 3 emissions, reported Scope 1 and 2 emissions of 23.94 million tons of CO2 in 2020, and 113 million tons of Scope 3 emissions.

So, you can see why fossil fuel companies don't want to disclose these emissions. But the official response to the suggestion by the Canadian oil and gas lobby group, the Canadian Association of Petroleum Producers, is the thing that I am calling disingenuous. They say, "We believe this would not only add additional burden to industry, but is also not practical in that upstream oil and gas producers don't have knowledge or control over the end use of their sales products".

So, essentially they are saying that they have no idea what happens to the oil and gas they sell. Well, I can throw some light on that. It gets burnt. That's why people buy the stuff. To say that they "don't have knowledge" of what happens to the oil and gas they sell is almost the definition of disingenuous. And clearly, Cenovus have managed it for the last couple of years at least, so everyone else could too. If you mean that you don't want to see this kind of disclosure become a requirement because it's going to be extremely embarrassing, then say that. Don't try and hide it under a bushel.

Canada is already lagging on environmental disclosure. Currently, about 70% of companies on the S&P/TSX Composite Index provide any disclosure at all on CO2 emissions, mainly reporting of Scope 1 and 2 emissions. This is slightly better than US-listed companies (67%), but well below those in Europe (89%) and the UK (99%). And you have to know which are the companies that are most reluctant to disclose their carbon footprint.